Xolo Review

If you’re a freelancer, solopreneur, or digital nomad working online and internationally, doing your taxes can be a bit of a headache. After years of carefully reviewing everything on paper so that my accountant would know what it was, I decided to look for a better option. Enter Xolo, a tax and accounting service for solopreneurs launched as Leapin in 2015.

Xolo offers two main services:

A simple and fast accounting tool to pay customers and track international expenses as a freelancer

Establishment of a company in Estonia and all required tax filings from a convenient dashboard

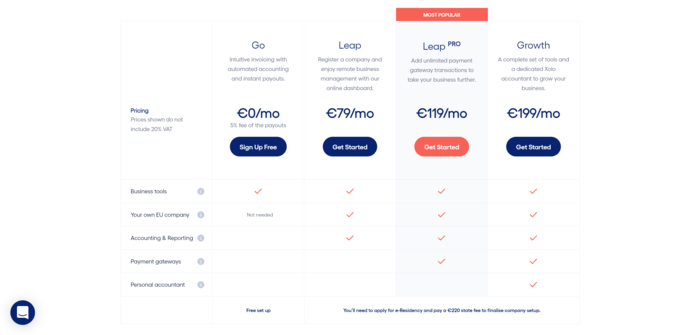

These services are divided into four different plans: Xolo Go, Xolo Leap, Xolo Leap PRO, and Xolo Growth. This Xolo review will explain the differences between these features and focus on my personal experience entering and using Xolo Leap for my business.

XOLO REVIEW: ESTONIAN COMPANY FORMATION AND INVOICING WITH XOLO LEAP

WHAT IS XOLO? XOLO LEAP VS XOLO GO VS XOLO GROWTH

Xolo Go is Xolo’s main feature and is ideal for freelancers who just want an easy – and legal – way to send invoices and payments without starting a business.

Xolo Leap, Xolo Leap PRO and Xolo Growth are all plans for those who want to start a business in Estonia safely. All these features include Estonian company formation, accounting tools and annual tax declarations made for you by Xolo.

The difference between the plans is what’s included, and of course the price goes up with the number of plans you get. With Xolo Leap, you can only use the smart account, formerly TransferWise, and the LHV bank account as a payment gateway. With Leap PRO, you can also add PayPal and Stripe. The difference between Xolo Leap PRO and Uto is that with Uto, you get a dedicated accountant while with Leap PRO you get general support from Xolo.

I use “” because I have found their support to be very good so far.

For a complete comparison of Xolo’s plans and pricing, check out their comparison page.

Extra costs

Aside from the monthly Xolo fee, there are a few other costs you need to take into account when setting up your Estonian company. The Xolo pricing page already mentions the €220 company registration fee the Estonian government charges, but you’ll also need to pay €18 for your Estonian Business Registry registration, and €120 for your Estonian e-residency if you don’t have that yet (or €100 if you go pick up the card in Estonia)

These are all just one-time costs, though, and once Xolo has set up your company, you’ll only be paying their monthly fee.

ESTONIAN COMPANY FORMATION WITH XOLO: THE PROCESS

0. Get your Estonian e-residency

To create an Estonian company, you need to have an electronic residence for Estonia. The application process is simple, but it can take up to eight weeks for your application to be accepted (or rejected, but I’ve never heard of anyone having their application rejected), then it still takes two weeks or three before you. – the home application – which you will also need – arrived at the embassy of your choice. I noticed, it only took two weeks for my application to be approved, then less than three weeks for the electronic residence application with card and card reader to arrive at the embassy.

Not all embassies are open every day or at a time that suits you, and you will need to make time to pick up your accommodation application, so it may take some time. to get everything you need before Xolo starts setting up your Estonian company. This is why I recommend that you join an online welcome program before applying to use Xolo Leap. You will need to become an e-resident, but if you do that first, your Xolo entry process will not be delayed for long. If you like, you can also start setting up Xolo, then they will remind you to get your e-residency before you start your business.

1. Apply to use Xolo

To sign up with Xolo, you first need to pick your plan. Once you’ve done that, the next step is to fill in an application form including some personal and business details so Xolo can determine whether they can serve you or not.

As mentioned before, Xolo only sets up Estonian companies that have just one shareholder, so that’s something you’ll have to confirm. You’ll also need to share what kind of business you plan on running as Xolo right now doesn’t support every type of business

Businesses that are currently not able to use Xolo are:

- businesses that buy and sell physical goods, including drop shipping and Amazon FBA businesses

- businesses involved in activities that require a special license in Estonia, such as financial services, travel agencies, and gambling sites

- businesses dealing with cryptocurrencies

- businesses holding ICOs to get funding

As someone who provides digital services, I was good to go.

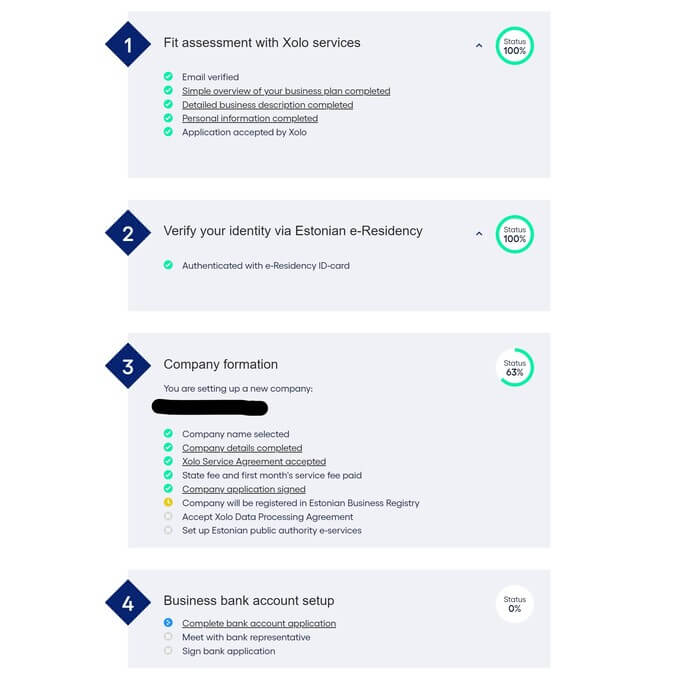

2. Follow the steps required to set up your Estonian company

Once you’ve been approved, Xolo guides you to a handy checklist of things you need to do to get both your company formed and your account set up. Here’s what that looks like:

[xolo signup process photo]

If you already have your e-residency card, steps 1 and 2 barely take up any time. My Xolo application got approved within 24 hours, verifying your identity takes just a few minutes, and then you can proceed to send Xolo the info it needs to set up your Estonian company.

There are a few things in regards to this process you should be aware of:

1. Choosing your company name

Xolo has a handy checker that allows you to see if another business already registered the name you have in mind in Estonia and whether that business operates in the same industry as you will.

When I entered the name I had in mind – Clarity Alley – I got a whole bunch of hits but they were all for a business called “Clarity”. I thought that was clearly a different name than “Clarity Alley” but it turned out that no word in your company name can be the name of an existing business registered in Estonia. I had to choose a different name but managed to solve the problem by just turning ClarityAlley into one word.

This slowed the setup down by two days or so, as you’re dependent on how fast they approve your company name.

2. It is not completely hands-off

Xolo does an amazing job at guiding you through the process and taking over every bit of the company formation process they can, but you’ll have to enter some information yourself and sign some things yourself as you are, after all, the company owner.

3. You don’t need to set up an account at a brick-and-mortar bank

While Xolo integrates with the Estonian LHV bank and helps you set up an LHV account if you want that, you don’t have to set up an LHV account. You can simply use a Wise, formerly TransferWise business account, and connect that to Xolo.

If you opt to just use Wise for your banking, step 4 is replaced with setting up a new Wise business account and linking that to Xolo.

4. Xolo doesn’t entirely control how fast things go

How long it takes to set up your Estonian company does not depend on Xolo alone. In fact, Xolo usually responded to all of my emails within just a few hours, often quicker and just once it took a day. For some things, however, you’re dependent on how fast the Estonian state processes things, and how fast your bank can send over certain data.

Overall, though, setting up your Estonian company through Xolo is a smooth and simple process.

USING THE XOLO SELF-SERVICE PLATFORM

The Xolo self-service platform is your user area. It’s where you can create invoices, upload expense documents, enter business trips, and get an overview of the state of your business bank accounts.

What I like about the self-service platform is that while you can log in with your e-residency card, you don’t have to. You can simply enter the email address you signed up with and then click a login link sent to your inbox.

I much prefer this over having to take out the card and card reader each time.

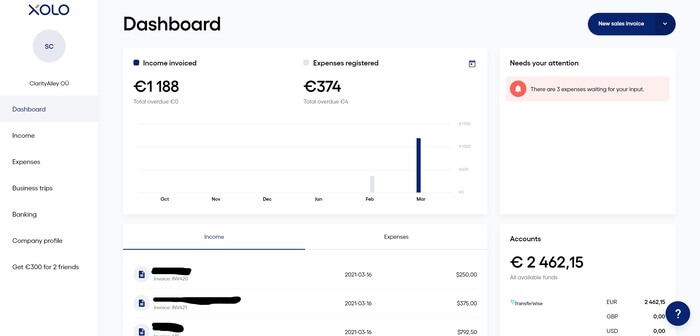

Xolo dashboard

The Xolo dashboard gives you an overview of the income you’ve invoiced, the total of expenses you’ve registered, and how much is in your connected bank accounts. You can see how much you made and spent per month on a clean graph which you can set to span three, six, or twelve months.

At the top of the dashboard, you’ll always find items that require your attention, such as overdue invoices or expenses for which you need to upload proof.

Xolo invoicing

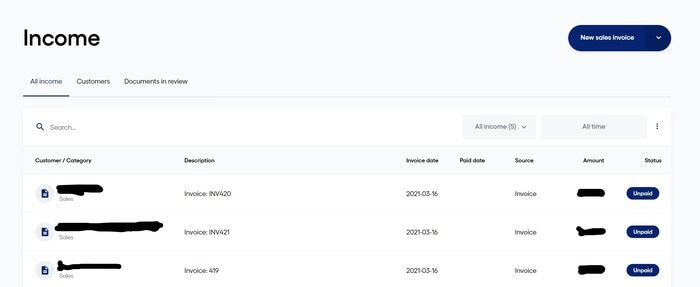

You can create invoices for your clients right in the Xolo self-service area on the “Income” page. Fill in the required fields, add additional information if necessary, and choose whether you want Xolo to send the invoice, or download it as a pdf so you can send it yourself.

Xolo allows you to set a standard message for your invoice emails which you can customize each time before you send out an invoice, and you can also save clients so it’s faster to create an invoice for them the next time you need to.

On the “Income” page, you also get an overview of the invoices you’ve sent, when you’ve sent them, when they’re due, and whether they’ve been paid already or not.

When you set up your account, you need to give Xolo read-only access to all your related business accounts. By doing so, the Xolo staff knows when you receive income and they then link that income to the correct invoice.

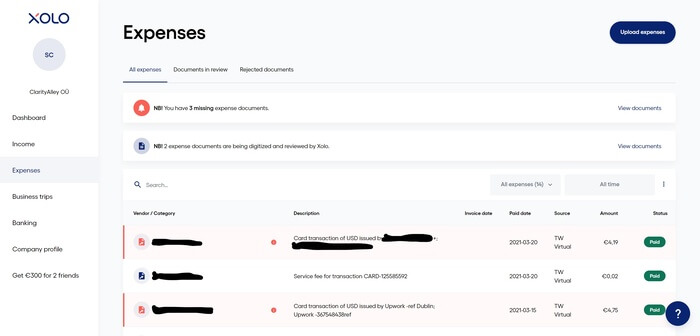

Xolo expense management

As Xolo knows when you earn money, it automatically records all of your expenses in your self-employment opportunity on the “Expenses” page. This makes it easier for you to identify the expenses you still need to raise the testimonials. I didn’t feel comfortable giving Xolo read-only access to my account at first, but luckily you don’t have to save anything yourself. There is only one solution to this, and that is to be careful not to use your business account to pay personal expenses, because these will be automatically recorded and taken as this profit will be taxed to you. . . ,

Xolo business travel registration

Estonia is very strong when it comes to business travel expenses, so Xolo’s personal service platform has a unique opportunity to record them. Due to the pandemic, I haven’t had to go on any business trips, so I’ll update this section when I start attending meetings again. Notifications on Xolo Leap Bank

Xolo’s personal service area contains an overview of all your Xolo-related accounts and the various amounts those accounts hold. Yes, Xolo supports a lot of money!

Note that any account you use for your business in Estonia must be recognized by Xolo. As mentioned earlier, you can get an LHV account that requires you to go to Estonia to open the account, connect a smart business account, and connect a PayPal business account if you have signed up for Xolo Leap Pro or Xolo Growth.

It is important to mention here that any bank account you connect to Xolo must be a completely new account. If you have worked as a freelancer and already have bank accounts that you used for the business, you cannot connect them to Xolo. As far as Xolo and the Estonian government are concerned, your Estonian company is new, so there is no financial report. If you want to open a new PayPal business account, be sure to visit https://www.paypal.com/ee/. If you go to PayPal as usual, it will send you to your local PayPal site and it’s easy to open a PayPal Estonia account from the Estonia site. It also means you can’t transfer your freelancing money into your new account to cover expenses. What you can do is to use the €2,500 share of capital that you have to pay to establish your company or to give a personal loan from other accounts with your new company at 0% interest. If you want to do the latter, Xolo will walk you through one.

What about spending money? Although Xolo prefers that you only pay for business expenses from your linked account, it can still pay in cash. In this case, however, you will be able to upload a receipt for the deductions you made specifically for this expense. On the other hand, you can record money as paid “out of pocket”, meaning that you paid for it yourself, only for your company to pay for it later. This also works for payments from your personal account. Accounting, tax and compliance

Self Service Area is a tool that allows you to manage your bills and expenses, but you don’t have to worry about anything beyond that. Xolo takes care of your accounting, compliance and tax returns.

XOLO CUSTOMER SERVICE

Wanting to make sure I understood the legal aspects of everything I was doing and how Xolo worked, I asked their support a lot of questions both during the setup process and once I started using their self-service system. They always respond quickly, kindly and with the information I need.

I have nothing more to say at this time. They only do customer support as it should be.

XOLO App

I can work online, but I’m not a big fan of mobile apps just because I prefer to work with a keyboard and a big screen. Because of this, and because I haven’t traveled since I started using Xolo, I haven’t used the Xolo app very well.

What I noticed about it and liked it is that you can easily take a photo of an invoice or receipt when you spend on transactions and travel through the application. XOLO jumped against

That all sounds pretty good, right? In fact, I’ve only been using the Xolo for a month or two now, and I can’t wait to see how things turn out once I’ve been with them for a year. So far, I’ve only seen a few things that aren’t my biggest interest:

When you register your business through Xolo, they give you an address in Estonia and send any information you can get there by email, which is great. However, their terms and conditions state that if for any reason they decide you are no longer a provider of your address, you only have 14 days to change your business address elsewhere, but you have to pay €500. I don’t want this to be a problem, but the short change of address scared me.

They should receive all of your expense documents within a month, and if proof of the expense is not uploaded within seven days of the expense, it is tagged as “overdue.” Although this keeps you on top of everything and I usually do my accounting every week, the seven-day rule doesn’t leave much room for holidays or for unexpected emergencies. get up and finish your job.

XOLO LEAP Review Summary

If you are an independent contractor who wants to start a business in Estonia and do not want to deal with the problems of accounting, compliance and taxes, Xolo Leap is a great solution at a reasonable price. Their support is very responsive and their dashboard is easy to use.

And if you’re thinking of signing up, I have a little gift for you…

Get €100 credit when you sign up

If you are considering setting up an Estonian company and want to use Xolo to manage the process and provide you with a simple self-service dashboard to manage your account, you can get €100 immediately in your new Xolo account and if you are registered. using my link. I earn €300 every time two people I refer sign up and earn at least €2,000 through Xolo.

I signed up with Xolo before I knew about their referral program and I wouldn’t recommend them if I wasn’t happy with them so far. As I said, I will update this post as soon as I file my first tax return in Estonia and have been using Xolo for at least a year.