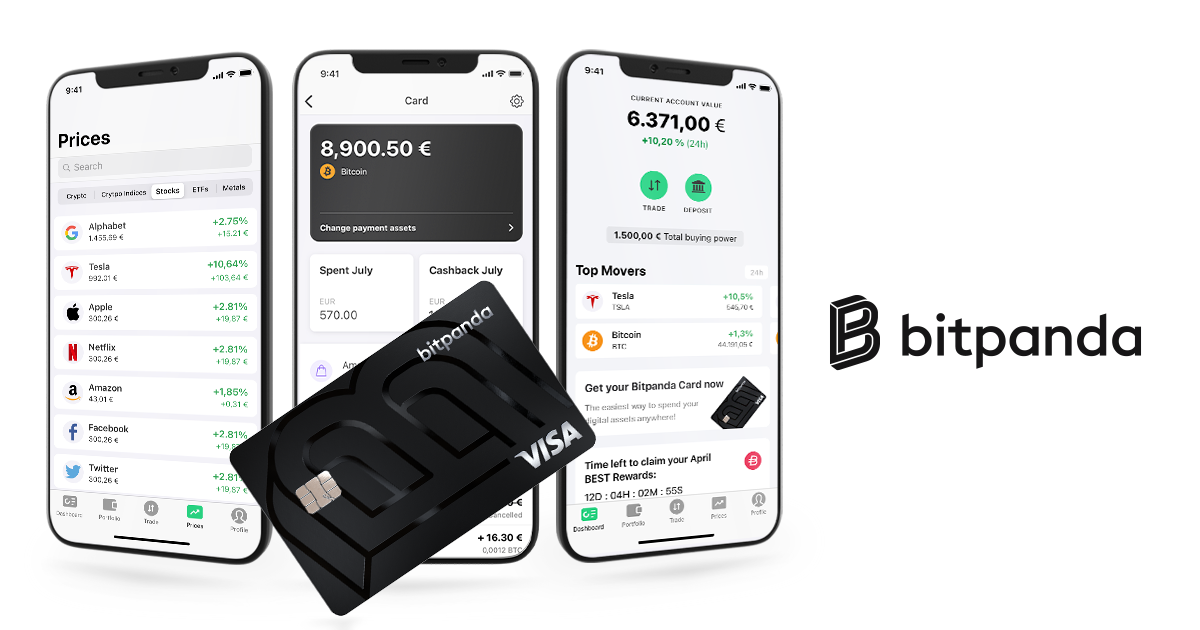

Bitpanda is a European crypto broker that trades cryptocurrencies, stocks, ETFs, and commodities. Unfortunately, it is not available in the U.S. The platform stands out for its low fees, crypto index fund, and intuitive interface. Read our full Bitpanda review to find out if this platform is right for you.

Full Bitpanda review

This cryptocurrency broker is a good fit for: European investors who want to manage all their assets in one place.

Pros

- Crypto index fund

- Trades stocks and commodities

- Extremely user friendly

- Great educational resources

- Bitpanda Visa card

- Low fees

Cons

- Not available in the U.S.

- No interest-earning features

- Limited crypto range on Bitpanda Pro platform

- Crypto deposit fees

Top perks

Bitpanda has a lot to offer European investors, as it makes it easy to trade a variety of assets. Here are some of the platform’s big advantages:

Crypto index fund

Not only does Bitpanda have a decent range of cryptos available, it also offers three crypto index funds. These contain the top five, 10, or 25 cryptos by market cap, and make it easy for European investors to diversify their crypto portfolios without having to buy each individual coin or token.

Also trades stocks and commodities

Bitpanda sells stocks, ETFs, and commodities such as gold and silver as well as cryptocurrencies. This makes it a good option for investors who want to manage all their investments in one place and ensure crypto makes up part of a diversified portfolio. Plus, customers can easily swap between one asset and another.

Extremely user friendly

Bitpanda has a tremendously intuitive interface. From the know-your-customer (KYC) verification to the trading, every aspect of the platform feels well thought out and is easy to use. Fee information is clear and transparent. Bitpanda has taken the same approach with its mobile apps.

The Bitpanda academy contains a lot of useful information, broken down for different types of investors. For example, beginner investors might want to know how blockchain technology works, and what a crypto wallet does. Intermediate articles cover things like consensus models and smart contracts. The expert section is not yet available. At the end of each section, investors can test their knowledge with a 15-question quiz.

Bitpanda Visa card

People who live in countries that have adopted the euro can apply for the Bitpanda Visa card. This fee-free debit card offers between 0.5% and 2% in rewards on spending. Users can choose which assets they want to use for payments, making it easy to spend cryptocurrency. However, it’s worth noting that crypto spending may not be great for long-term, buy-and-hold investors.

TIP

Buying your first stocks: Do it the smart way

Once you’ve chosen one of our top-rated brokers, you need to make sure you’re buying the right stocks. We think there’s no better place to start than with Stock Advisor, the flagship stock-picking service of our company, The Motley Fool. You’ll get two new stock picks every month, plus 10 starter stocks and best buys now. Over the past 17 years, Stock Advisor’s average stock pick has seen a 524% return — more than 3.5x that of the S&P 500! (as of 2/3/2022). Learn more and get started today with a special new member discount.

What could be improved

Not available in the U.S.

Bitpanda is a European-focused crypto exchange based in Austria. It currently only accepts users from certain European countries, including the U.K., France, Germany, Spain, and Switzerland. Residents of the United Arab Emirates can also apply. U.S. residents cannot use this platform.

No interest-earning features

Many crypto platforms offer users a way to earn interest on their crypto. This may be by staking certain coins to help validate transactions and contribute to that network’s security, or by loaning out your crypto to earn interest. Bitpanda does not offer these options.

Limited crypto range on Bitpanda Pro platform

Bitpanda has two trading platforms aimed at beginner and advanced traders. The Pro platform has lower fees, but is limited, as it only trades 20 cryptocurrencies. Most of these can only be traded with euros, and can’t be traded with each other. In contrast, the basic platform allows customers to swap cryptocurrencies for stocks or commodities and back again.

Crypto deposit fees

Most platforms do not charge a fee for crypto deposits, which is useful because you often pay a withdrawal fee on the other end. The fees aren’t huge, and Bitpanda does waive it for deposits over a certain amount (which varies per crypto). But it would be good to see this fee eliminated altogether.

Alternatives to consider

If you want a cryptocurrency broker that’s available in the U.S.: SoFi Invest offers many of the same features as Bitpanda, including stocks, ETFs, fractional shares, and cryptocurrencies. It trades more than 30 cryptocurrencies, and may be worth a look if you want to manage a diversified portfolio in one place.

If you want a U.S.-based crypto platform with free crypto deposits and withdrawals: Gemini is a popular pure cryptocurrency exchange. It lists a wide range of cryptos, but does not sell stocks or other investments. It is one of the few exchanges to offer a limited number of free crypto withdrawals each month.

How Bitpanda works

Bitpanda is a cryptocurrency broker that also sells stocks, ETFs, and commodities like gold and silver. It has a wide selection of stocks and ETFs. It also offers fractional share trading, which lets investors buy as little as 1 euro of a stock. Customers who employ dollar cost averaging can also set up recurring buys.

Bitpanda does not have its own crypto wallet. However, it does let users send and receive cryptocurrency on its platform. This sets it apart from other crypto brokers. Its Bitpanda apps on iOS and Android are rated 4.8 and 3.5 out of 5, respectively. Outside of the rewards it pays on its Bitpanda Ecosystem Token (BEST) token, the platform does not offer ways to earn interest on crypto assets.

READ MORE: Best Cryptocurrency Apps

Bitpanda also offers some users a way to spend their crypto — customers in countries that have adopted the euro can apply for the Bitpanda Visa card. This debit card earns crypto rewards on spending, and makes it easy to spend cryptocurrency and other assets. Be aware that spending crypto and other assets can have tax implications. Buy-and-hold investors who don’t want to dip into their investments for day-to-day spending can top it up with fiat currencies instead.

Fees overview

Bitpanda’s trading fees are in line with some of the best-value crypto exchanges, especially on the advanced trading platform. It also offers trading discounts and other perks for investors who hold its BEST utility token. Here’s how the trading, deposit, and withdrawal fees break down.

Trading fees

Bitpanda has trading platforms for Pro and basic users. The basic trading platform is more expensive to use, but more accessible for beginners. It charges a fee of 1.49%, built into the price you see. To buy 200 euros worth of Bitcoin (BTC) on the basic platform, you’d pay a transaction fee of 2.98 euros.

Experienced traders can reduce trading fees by using the Bitpanda Pro platform. Here, the maximum maker/taker fee is 0.1% to 0.15%. At most, it would cost 0.30 euros to buy 200 euros worth of Bitcoin on the Pro platform. Pro fees are reduced with higher trading volumes. The reason the fees differ is that Pro users trade at market prices, whereas the basic platform offers a 60-second price guarantee.

Trading fees

| PLATFORM | FEES |

|---|---|

| Bitpanda | 1.49% |

| Bitpanda pro | 0.1% – 0.15% |

Fiat deposit and withdrawal fees

Bitpanda makes it easy to deposit fiat money via bank transfer, credit card, debit card, and other methods. The interface is clear, and the fees are transparent and easy to understand. The minimum fiat deposit is around 25 euro, depending on the currency.

Fiat deposit fees

| METHOD | FEES |

|---|---|

| Bank transfer | Free |

| Credit / debit card (Visa and Mastercard) | 1.5% – 1.8% |

| Other payment processors such as Skrill and Neteller | Set fee plus 3.6% |

Crypto deposit and withdrawal fees

Bitpanda is unusual in charging fees for crypto deposits. Most exchanges offer this service for free. The fee isn’t crazy high — often around $5. But given that you usually must pay to withdraw it from the original location, it’s worth factoring the extra cost.

The crypto deposit fee gets waived for deposits higher than a certain amount of crypto. The minimum varies from crypto to crypto, but in many cases the fee-free threshold is around $150. Notable outliers are Avalanche (AVAX), with a minimum of about less $10, and Bitcoin, with a minimum of about $2,000.

Bitpanda’s withdrawal fees also vary from crypto to crypto. This is because different crypto networks charge different transaction fees. It can cost anything from less than a dollar to over $50 to withdraw crypto from Bitpanda.

Cryptocurrency selection

With over 80 cryptocurrencies on its books, Bitpanda has a solid selection of coins and tokens. It lists most of the top 20 cryptos by market capitalization, including Bitcoin, Ethereum (ETH), Binance Coin (BNB), Ripple (XRP), Cardano (ADA), and Solana (SOL). It also trades several stablecoins, such as Tether (USDT) and USD Coin (USDC).

It’s worth noting that the cryptocurrency selection is more limited on Bitpanda Pro, which also has fewer trading pairs. There are only 20 cryptocurrencies on the advanced platform, and most can only be paired with euros rather than other cryptocurrencies.

Bitpanda Crypto Index

One of the most interesting features on the platform is the Bitpanda Crypto Index. Bitpanda has three crypto index funds, each of which is rebalanced once a month to reflect the current market.

- BCI5: Made up of the top five cyptos by market cap. At time of writing, it consisted of Bitcoin (35%), Ethereum (36%), Binance Coin (14%), Cardano (7%), and Solana (6%).

- BCI10: This contains the top 10 cryptos by market cap, and Ethereum and Bitcoin made up about 60% of the fund.

- BCI25: With 25 cryptos, this is the most diverse index fund. Ethereum and Bitcoin make up about 35% of the total, while smaller cryptos like Sandbox (SAND), Fantom (FTM), and Chainlink (LINK) make up less than 2% each.

Crypto index funds can offer a great way to build a diversified portfolio. But investors also have less control over the individual holdings.

Is your cryptocurrency safe with Bitpanda?

Cryptocurrency can be a high-risk and volatile asset class. It’s also a relatively new industry with less investor protection than other asset classes, which makes it all the more important to look for platforms that protect your investments.

Bitpanda says it takes security seriously, and has some measures in place to protect its customers. For example, it keeps assets offline in cold storage, making them more difficult to hack. Accounting firm KPMG carried out an independent audit of Bitpanda’s reserves last year. It found the platform had more than enough funds to cover user assets.

It also offers several user-level protections. These include two-factor authentication and sending confirmation emails to authorize withdrawals. However, it would be nice to see some additional security features such as anti-phishing measures and third-party insurance. Several big crypto exchanges have outside insurance to cover user losses in the event of an exchange hack.