Best financial market platforms

Cryptocurrency trading has exploded in popularity, largely due to the rise (and twists and turns) in value of bitcoin, ether, dogecoin and more. And while it can be intimidating at first, and although scams have occurred and continue to happen, today’s best crypto exchanges and platforms make buying and selling crypto simpler and clearer than it has been before.

There are several ways and places to invest in cryptocurrency. Our list considers crypto exchanges and online brokers that offer crypto, as well as cash and payment apps that let you buy and sell bitcoin. Even those familiar with more traditional investing platforms should be mindful that crypto often comes with different fee structures, narrower customer service options and an increased role for the investor in security.

9,8

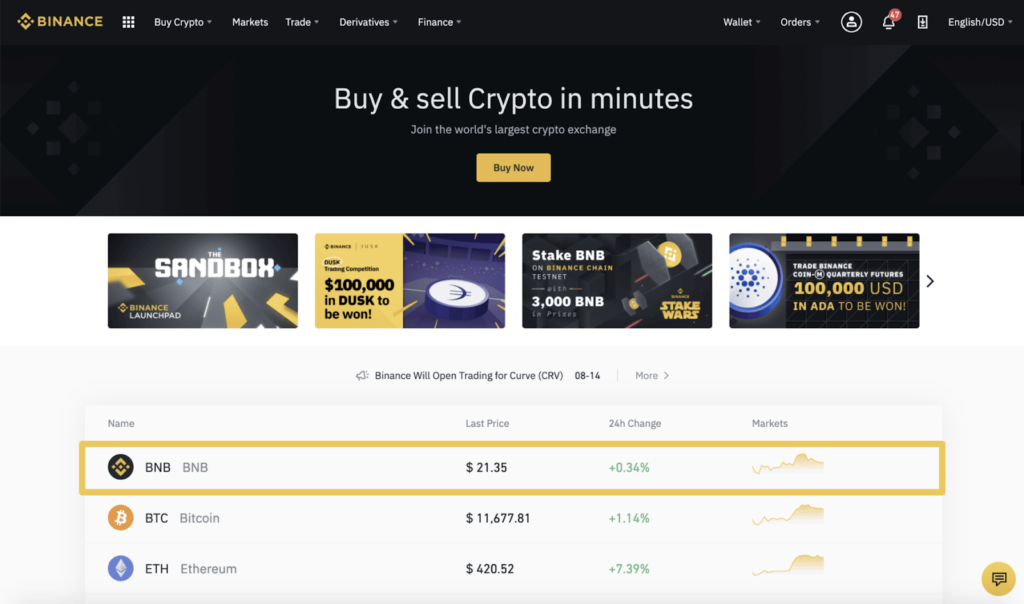

Binance

Binance is a popular cryptocurrency exchange designed for experienced cryptocurrency investors.

9,4

Capitalist Exploits

Capitalist Exploits is dedicated to finding asymmetric risk/reward investment opportunities. A monthly newsletter that provides you with the latest great investment opportunities.

9,1

Iq Option

IQ Option is a legit broker and one of the most reputable companies in the industry.

8,8

Bitfinex

Bitfinex offers relatively low trading fees compared to its competitors.

Best financial market platforms - an in-depth look

1) Binance

- Trading Experience

- Binance’s security features

Oferece taxas de negociação relativamente baixas e uma ampla seleção de criptomoedas para negociação globalmente, embora suas opções de negociação sejam mais limitadas nos EUA Embora suas taxas baixas possam ser atraentes, a plataforma enfrentou problemas regulatórios e está atualmente sob investigação nos EUA.

- Over 65 tradable cryptocurrencies for U.S. customers: Binance offers over 65 tradable coins for U.S. customers. This gives crypto traders and investors many options. If you’re outside of the United States, you have even more options.

- Low fees: The platform offers low fees, meaning traders get to keep more of their investment and earnings.

- Wide selection of trading options and order types: Binance offers several trading options including peer-to-peer trading, spot trading, and margin trading. It also offers lots of order types, including limit order, market order, stop-limit order, stop market order, trailing stop order, post only order, and one-cancels-the-other order. Some of these options including margin trading are not available for U.S. customers.

- Over 65 tradable cryptocurrencies for U.S. customers

- Low fees

- Wide selection of trading options and order types

- No built-in digital wallet available

2) Capitalist Exploits

- 30 day money back guarantee

When it comes to gurus and market advice, there is no shortage of services available to investors.

The fact of the matter is, we all want to get better, invest more efficiently, get ahead of the curve, and to make money.

Isn’t that the dream of investing, to make big returns and to set yourself and your family up for life?

Maybe you’ve stumbled across some of the slick, clever marketing making its way around investing sites like Zero Hedge or Investing.com.

Or, perhaps a friend or fellow trader sent you an exciting note claiming “+1000% returns” and mumbling on about “asymmetric risk/reward investment opportunities.”

Being the astute investor, you had to at least take a look at the claims for yourself.

In this review, we’re taking a hard look at an investment advice company that promises massive returns — just subscribe to, learn from, and trade alongside the experts at Capitalist Exploits.

At the helm of the service is Chris MacIntosh, less captain and more revered leader. His storied past and claims of intimate market knowledge have driven people to shell out big bucks to learn at his feet.

Our review will examine Capitalist Exploits, the good, the bad, and the ugly.

As a disclaimer, we did not gain access to Chris’s subscriber-only sections, so we won’t be able to get underneath the hood, but we can still help you decide if this service is right for you.

- Monthly investing opportunities

- Excellent customer reviews

- Opportunities for large investing gains

- Subscription fees must be paid for a year upfront.

3) Iq Option

- Demo account

IQ Option is an online trading platform that allows you to trade a variety of financial instruments including binary options, stocks, forex, ETFs, commodities, and cryptocurrency.

This broker was founded in 2013 and is operated by IQ Option LTD. IQ Option has rapidly become one of the most popular trading platforms for traders across the world with over 48,000,000 registered users and over 1,000,000 transactions per day. IQ Option accepts traders from over 213 countries including India, Nigeria, South Africa, The Philippines, Malaysia, Pakistan, Singapore, and many more.

In this IQ Option review, I’ll tell you everything you need to know about this broker to help you decide whether or not this company is right for you.

- Mobile App

- Minimum deposit of $10

- Not available in some countries

4) Bitfinex

- Low trading fees

Bitfinex is a large cryptocurrency exchange supporting a large ecosystem of cryptocurrency products and trading options, including spot trading, margin accounts, derivatives, paper trading, and more. With a mix of features suitable for both beginner and expert crypto users, Bitfinex likely offers everything you need to manage your cryptocurrency in one place.

Bitfinex is one of the older cryptocurrency exchanges, founded in 2012. The exchange has remained a leader in cryptocurrency trading since its founding, currently holding the number eight spot among the largest cryptocurrency exchanges in the world by volume, according to CoinMarketCap.

- Margin trading, derivatives, and advanced order types supported

- Paper trading and mobile app suitable for newer cryptocurrency traders

- Not available in the United States

Aplicativos de dinheiro e pagamento

Vários aplicativos de pagamento em dinheiro e ponto a ponto agora permitem que os usuários comprem e vendam bitcoin. No geral, esses aplicativos são mais limitados no que oferecem do que as bolsas e corretoras acima.

CashApp

CashApp, um sistema de transferência de dinheiro peer-to-peer executado pela Square, permite que os usuários comprem e vendam bitcoin. Ao contrário de outros aplicativos de dinheiro mencionados aqui, o Cash App permite que os usuários transfiram seus bitcoins para sua própria carteira de criptomoedas . O Cash App cobra uma taxa dependendo da volatilidade dos preços e do volume de negociação do mercado, que revela no momento da compra.

O Cash App limita as retiradas de Bitcoin em até US$ 2.000 por dia ou US$ 5.000 em qualquer período de sete dias.

PayPal

O PayPal permite que os usuários comprem e vendam bitcoins, mas devem ser armazenados no site do PayPal: Os usuários não podem transferir criptomoedas para sua própria carteira digital. As taxas incluem uma taxa de negociação estimada de 0,5% (isso pode variar dependendo das condições do mercado) e uma taxa de transação escalonada dependendo da quantidade de criptomoeda comprada, variando de 2,3% para valores entre US$ 25 e US$ 100 e 1,5% para comprar ou vender mais de $ 1.000 em bitcoin. Compras abaixo de US $ 25 são cobradas 0,5%. Os usuários podem comprar até US$ 20.000 por semana, mas não mais de US$ 50.000 durante o período de um ano.

O PayPal permite que compras sejam feitas com bitcoins quando disponíveis, mas você precisará pagar impostos sobre a venda de bitcoins além de quaisquer impostos relacionados à compra dos bens ou serviços.

Venmo

Venmo is the latest cash app to introduce cryptocurrency sales and purchase, but unlike other providers gives a choice of four coins: bitcoin, ether, bitcoin cash and litecoin. Venmo’s fee structure mirrors PayPal: estimated 0.5% trading cost, plus tiered transaction fees of 2.3% for crypto trades of $25 to $100, lowering to 1.5% for trades more than $1,000 (0.5% charged on crypto purchases below $25).

Limits are $20,000 a week, and no more than $50,000 in a 12-month period.

How is investing in crypto different from traditional investment in stocks, bonds and funds?

Trading cryptocurrencies is different from traditional investing in several ways:

Compared to traditional investing, which has seen fees steadily decline in recent years, trading in cryptocurrencies costs much more. For example, depending on the method of payment you could pay 5% or more in fees when trading bitcoin. Purchasing investments through a robo-advisor, however, can cost as little as 0.25%, keeping more of your cash invested.

Crypto is a new and burgeoning industry, and customer service has lagged behind what’s available at traditional brokerages. Want to speak to a person concerning questions or account issues at crypto exchange? No pure crypto exchanges we review provide that service.

Você tem mais responsabilidade por proteger sua criptomoeda contra roubo com trocas de criptomoedas, especialmente se você usa sua própria carteira digital. Embora as exchanges protejam você contra perdas devido a hacks em todo o site, você não estará protegido contra ataques individuais à sua conta — por exemplo, um ataque de phishing por e-mail no qual você revela involuntariamente suas senhas a cibercriminosos.

Divulgação: O autor não detinha posições nos títulos mencionados no momento da publicação.